- SUPPLIER RISK MANAGER DUN AND BRADSTREET ARCHIVE

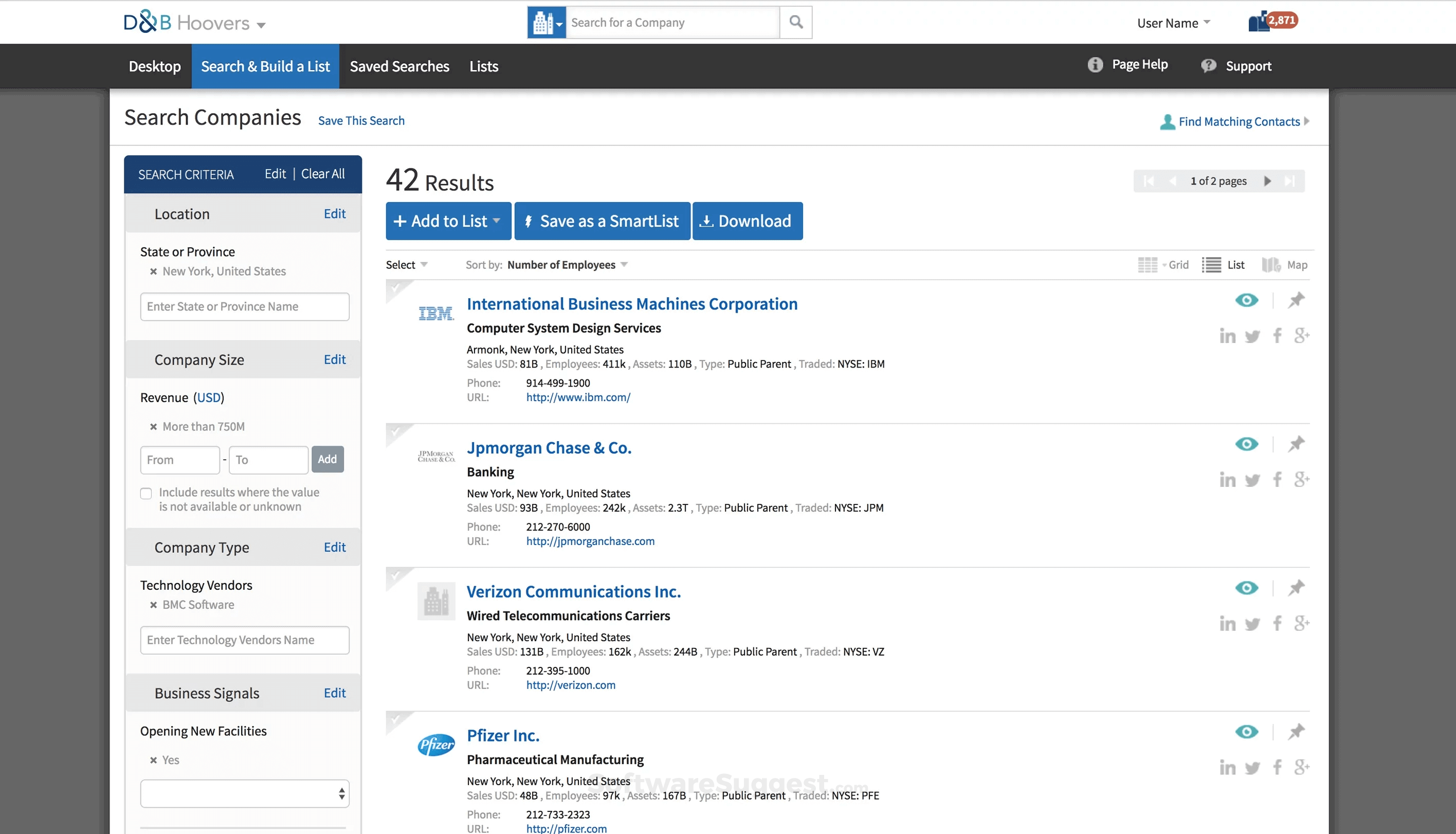

- SUPPLIER RISK MANAGER DUN AND BRADSTREET SOFTWARE

- SUPPLIER RISK MANAGER DUN AND BRADSTREET FREE

Add convenient weekly and monthly email newsletters to your subscription to keep your finger on the pulse of the industry.

SUPPLIER RISK MANAGER DUN AND BRADSTREET ARCHIVE

Every article, every chart and every table as it appeared in the magazine for all archive issues back to 2009. Delivered by email faster than printed issues.

Searchable replicas of each magazine issue.

SUPPLIER RISK MANAGER DUN AND BRADSTREET SOFTWARE

The company’s software as a service (SaaS) platform gives organizations the control to assess, measure, and mitigate risk and to ensure the optimal performance of key business processes. ProcessUnity is a leading provider of cloud-based applications for risk and compliance management.

SUPPLIER RISK MANAGER DUN AND BRADSTREET FREE

ProcessUnity VRM provides powerful capabilities that automate tedious tasks and free up risk managers to focus on higher-value mitigation strategies.ĭownload the D&B Connector datasheet to learn how ProcessUnity and Dun & Bradstreet are working together to mitigate third-party risks across the globe. Combining a powerful vendor services catalog with risk process automation and dynamic reporting, ProcessUnity VRM streamlines third-party risk activities while capturing key supporting documentation that ensures compliance and fulfills regulatory requirements. ProcessUnity Vendor Risk Management is a software-as-a-service (SaaS) application that helps companies identify and remediate risks posed by third-party service providers.

This enhanced offering can provide the financial risk data necessary for organizations to mitigate and reduce third-party risk globally.” “External risk intelligence is now a must-have for organizations looking to mature their third-party risk management programs. “ProcessUnity’s connector to Dun & Bradstreet provides risk managers the ability to understand and actively monitor the financial health of their vendors,” said Todd Boehler, Senior Vice President of Strategy, ProcessUnity. If a score drops, third-party risk managers are notified to ensure organizations are able to respond to adverse changes in their vendors’ financial health. These serve as indicators of financial condition and the implied risks associated with doing business with a specific organization. ProcessUnity’s D&B Connector delivers multiple financial risk metrics, including Dun & Bradstreet’s Supplier Stability Index, Supplier Evaluation Risk (SER) Rating, Financial Stress Score, Viability Rating, Standard Rating and more. “With this additional data and insight, executives can make confident decisions in the selection process and mitigate risk through proactive ongoing monitoring.” “Our collective partnership ensures clients have access to the global financial risk data needed to make more informed decisions not only during initial vendor onboarding but also throughout the lifecycle of the relationship, said Brian Alster, General Manager, Dun & Bradstreet Third-Party Risk & Compliance Solutions. The D&B Connector seamlessly incorporates objective financial health assessments into ProcessUnity’s vendor risk platform for enhanced vendor due diligence.

0 kommentar(er)

0 kommentar(er)